The virus mutates, how about our consumers?

How about our IQ levels after the COVID quarantine?

24 Mayıs 2020he virus #covid19 entered into our lives without asking any permission and also changing our behavior, reactions to stimuli that we thought as constant. They are adopting new brands, channels, and behaviors; interestingly, they say they will keep.

#stay_at_home #consumerbehaviour #onlineretail #ecommerce #retailtrends #ecommercetrends #futureofretail

Linkedin Link: https://lnkd.in/exmWGkY

As consumers stay at home, they expect reduced income and expenses. Nonetheless, they report areas of increased spending and are adopting new brands, channels, and behaviors; interestingly, they say they will keep.

Trauma pushed many of them toward digital channels, products, and services across categories, but that shift has not come close to offsetting the overall reduction in spending.

Recent surveys made by McKinsey and EY show profound changes in the behavior of the consumers. It looks like these developing shifts will be the new normal, whereas all stakeholders are expected to revisit their well-accepted fact set.

According to the EY study, the COVID-19 crisis created four distinct consumer behavior segments, a survey tracking consumer sentiment and behavior across the US, Canada, the UK, France, and Germany.

Consumers that fall into the Cut Deep segment (27.3%) are spending less across all expense categories as the pandemic impacts employment; others representing the Stay Calm-Carry On type are continuing to spend as average (26.2%). Most consumers (35.1%) represent the Save and Stockpile segment, indicating that they feel pessimistic about the future, while consumers that fall into the Hibernate and Spend part (11.4%) are spending more across the board.

Overall, 42% of respondents think that how they shop until now will fundamentally change as a result of the COVID-19 outbreak. When it comes to brands and products, 34% of consumers indicate that they would pay more for local products, 25% for trusted brands, and 23% for ethical products.

• Cut deep: These consumers are mainly more than 45 years old and have seen the most significant impact on their employment status. Almost a quarter have seen their jobs suspended, either temporarily or permanently. Seventy-eight percent of them are shopping less frequently, while 64% are only buying essentials. Thirty-three percent feel that brands are far less critical to them in the current climate.

• Stay calm, carry on: These consumers do not feel directly impacted by the pandemic, and are not changing their spending habits. Just 21% of them are spending more on groceries, compared with 18% that are spending less.

• Save and stockpile: This segment shows particular concern for their families and the long-term outlook. More than a third (36%) are now spending more on groceries, while most are spending less on clothing (72%) and leisure (85%).

• Hibernate and spend: Primarily aged 18-44, and these consumers are most concerned about the impact of the pandemic. However, only 40% of this segment say they are shopping less frequently. And while 42% say the products they buy have changed significantly, 46% of them say brands are now more important to them.

These new consumer segments are proposed to evolve post-COVID-19 and be summarized as:

• Keep cutting. 13% of consumers. Least educated. Least likely to be working. Making deep spending cuts and changing what they buy and how. The pandemic was always a huge worry.

• Stay frugal. 22% of consumers. Spending slightly less, but some deep cuts. Trying to get back on their feet. Among the most pessimistic about the future.

• Get to normal. 31% of consumers Spending mostly unchanged. Daily lives were never really affected. Least concerned about the pandemic overall.

• Cautiously extravagant. 25% of consumers Middle to high income. Highly focused on health but relatively optimistic despite a strong belief that a global recession is coming. Will spend more on areas vital to them.

• Back with a bang. 9% of consumers. Younger and at work. Spending much more in all categories. Their daily lives were most disrupted. Now they are the most optimistic.

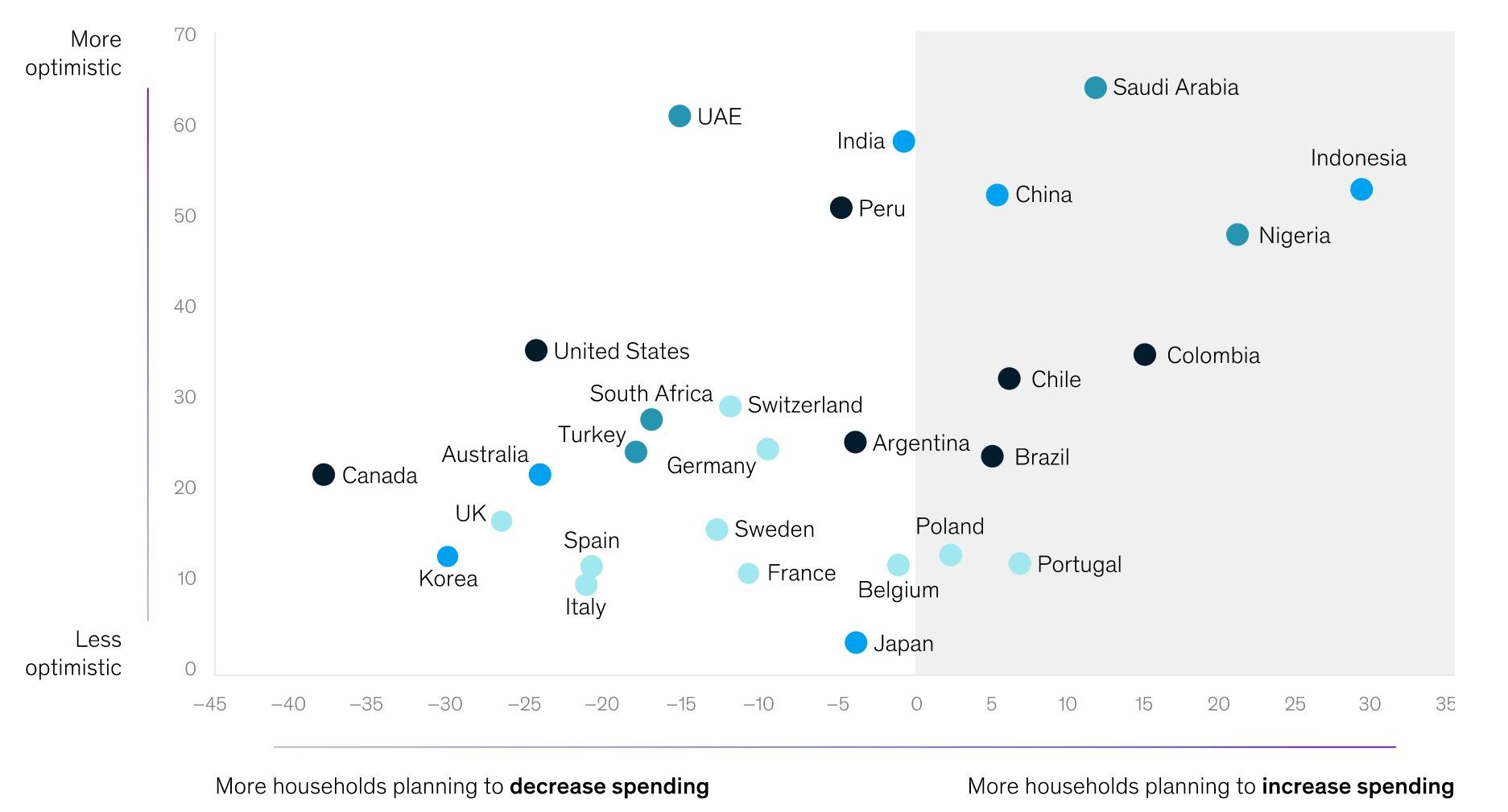

McKinsey’s recent survey suggests that optimism and anticipated spending correlates globally. Signs of back to the usual routine and no-layoff news in China show a strong optimism for the future and an increase in spending. KSA, Indonesia, and Nigeria follow the trend. The rest of the world, representing a significant portion of the global economy, are more pessimistic and hence planning to spend less. In the lower-left quadrant, Korea, UK, Australia, and with a better expectancy, Turkey, Germany, Switzerland are placed. Though Japan looks like having the most pessimistic sentiment of all, consumers are planning to spend like the same post-Covid19.

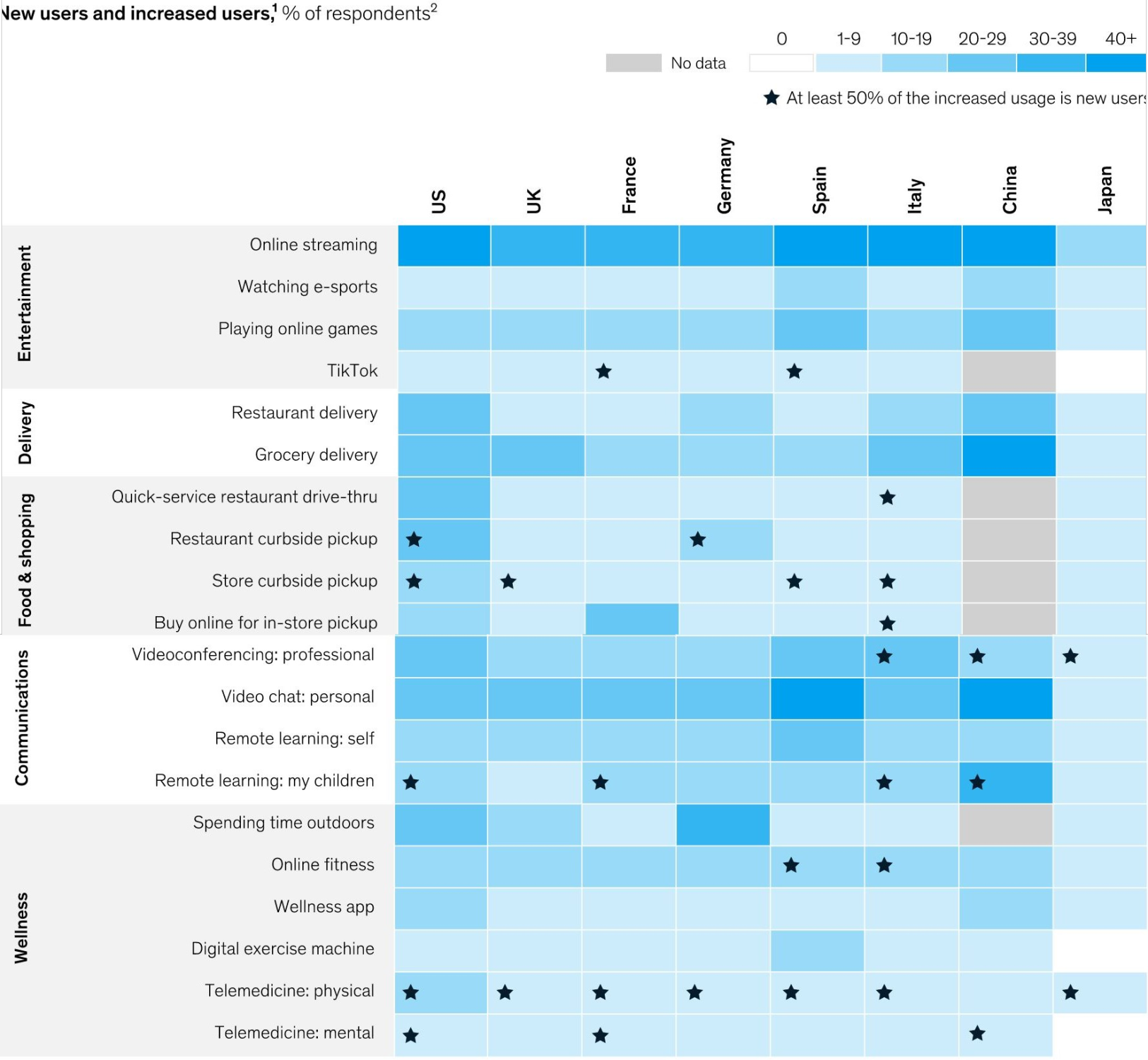

One of the most critical shifts to follow is the digital adaptation of the consumers. Early adopters always led the way to utilize new products and applications. Amid Covid19, regardless of age, gender, and country, many consumers downloaded apps and tried new methods of buying.

Starred cells show new users accounted for at least 50% of the total usage. Physical and mental telemedicine looks like a new trend. Italy and Spain, which citizens stayed at home for a very long time, tried online fitness. Mediterranian countries are more prone to offline shopping inherently, however buying online increased, and many new users tried. Similarly, videoconferencing for both work and personal uses has gained in popularity across the countries surveyed.

We have to follow carefully how much of these new users will stay digital and continue to utilize.

While many consumers have started shopping online for groceries during the pandemic, future intent for online grocery shopping is mixed. Consumers in the UK, Italy, and Japan intend to do more online grocery shopping, while American, German, French, and Spanish consumers anticipate doing less.

Consumers remain hesitant to return to some of the activities that were part of their daily life before the start of the pandemic. Consumers globally do not intend to undertake international travel soon, while consumers in several countries—except for Germany and France—plan to restrict domestic travel as well. Most consumers expect to shop less frequently in physical stores for items other than grocery, simultaneously shifting that spending online.

In the next article, I plan to focus on particular countries and possible retail shifts for the coming period.

We have to follow carefully how much of these new users will stay digital and continue to utilize.

While many consumers have started shopping online for groceries during the pandemic, future intent for online grocery shopping is mixed. Consumers in the UK, Italy, and Japan intend to do more online grocery shopping, while American, German, French, and Spanish consumers anticipate doing less.

Consumers remain hesitant to return to some of the activities that were part of their daily life before the start of the pandemic. Consumers globally do not intend to undertake international travel soon, while consumers in several countries—except for Germany and France—plan to restrict domestic travel as well. Most consumers expect to shop less frequently in physical stores for items other than grocery, simultaneously shifting that spending online.

In the next article, I plan to focus on particular countries and possible retail shifts for the coming period.